2019 Property Taxation: Distribution of Property Tax Levy

Below is a letter CEO David Hutniak sent to City of Vancouver Mayor, Kennedy Stewart and the City Council on April 25th. We encourage all rental housing providers to write Mayor Stewart and Council requesting that they accept City of Vancouver Staff’s recommendation NOT to implement this proposed tax shift. Emails can be sent to Mayor and Council here: [email protected]

Dear Mayor Stewart and Council,

I am writing on behalf of LandlordBC, the province-wide voice of the rental housing industry in British Columbia. LandlordBC’s primary mission is to facilitate the professional and responsible provision of safe, secure, sustainable long-term rental housing for British Columbians.

We strongly support the City of Vancouver Staff recommendation that Council NOT implement a proposed 2% tax shift from commercial to non-commercial (residential) properties. While we are not insensitive to the challenges small business commercial tenants are experiencing in the City of Vancouver, we wish to remind Council that secure purpose-built rental buildings are classified as residential for property tax purposes, and thus would be directly and negatively impacted if this proposed tax shift were to proceed. We are facing a rental housing crisis, and if this proposed tax shift were to proceed it would place further undue cost pressure on rental housing providers and contribute significantly to the affordability and supply challenges across the City. The unintended consequences of this proposed tax shift are that residential renters will ultimately suffer.

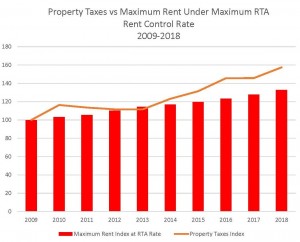

Rental housing providers operate in a heavily regulated environment where costs are increasing exponentially while the ability to recover those costs is severely restricted. One of the major cost-drivers we must absorb as rental housing providers is property taxes. In a September 2018 study, LandlordBC undertook an analysis of the major cost-drivers* in the operation of a rental property over a 10-year period. Unsurprisingly, we demonstrated that total operating costs for a rental property over that time period increased 7.6% per annum, while the compound maximum allowable annual rent increase permitted under the Residential Tenancy Act for that same period of time was 3.2%. An operational shortfall of 4.4% per annum. Rental housing providers simply cannot absorb the additional costs that would result from this proposed tax shift. A chart from the study specific to property taxes can be found below.

* Property taxes, Insurance, Water & Sewer, Repair & Maintenance, Electricity/Natural Gas

In closing we wish to reiterate that we strongly support the City of Vancouver Staff recommendation that Council NOT implement a proposed 2% tax shift from commercial to non-commercial (residential) properties. We respectfully ask that you do the same.

Sincerely,

David Hutniak

Chief Executive Officer

LandlordBC